Having the right insurance is essential for peace of mind while driving. As part of ICBC’s Enhanced Care, ICBC Basic Vehicle Damage Coverage offers financial protection to vehicle owners in specific situations.

Whether you’re familiar with it or exploring your insurance options for the first time, this guide will break down the key aspects of this coverage to help you make informed decisions and ensure your vehicle is properly protected.

Overview of ICBC’s Basic Vehicle Damage Coverage

ICBC’s Basic Vehicle Damage Coverage is a fundamental insurance component for drivers in British Columbia, introduced under the Enhanced Care model on May 1, 2021. This coverage is designed to help with the repair or replacement of your vehicle if it is damaged in an accident caused by another driver.

Key Features:

- Coverage Limit: Up to $200,000 for vehicle repairs or replacement.

- Eligibility: Applies when the other driver is determined to be at fault.

- Inclusions: Coverage extends to towing, storage, and loss of use expenses, providing comprehensive financial support.

Purpose of Basic Vehicle Damage Coverage

The purpose of this coverage is to offer financial protection in situations where your vehicle is damaged through no fault of your own. Think of it as a safety net that prevents car repairs from becoming an unexpected financial strain, ensuring peace of mind on the road.

ICBC Enhanced Care Benefits: A Game Changer

The Enhanced Care model, launched in 2021, has transformed ICBC’s approach to insurance by emphasizing affordability and fairness. This system reduces premiums while providing broader coverage for drivers, making vehicle insurance in British Columbia more accessible and comprehensive.

All About ICBC Insurance Coverage Details (What You Need to Know)

ICBC’s Basic Vehicle Damage Coverage provides essential financial protection for British Columbia drivers. It covers the repair or replacement of your vehicle, along with towing, storage, and compensation for loss of use, ensuring you’re supported while your vehicle is being repaired.

With a coverage limit of up to $200,000, this policy offers substantial financial security in the event of an accident.

Coverage Scenarios: Careless Drivers and Lack of Insurance

Accidents can be stressful, especially when the other driver is at fault or lacks sufficient insurance. ICBC’s Basic Vehicle Damage Coverage offers vital financial protection in these situations, ensuring you’re not left to cover significant expenses.

When Another Driver is Responsible

If another driver is at fault in an accident, ICBC’s Basic Vehicle Damage Coverage steps in to help:

- Vehicle Repairs or Replacement: Covers repair costs or, if the damage is extensive, the replacement of your vehicle.

- Peace of Mind: This coverage ensures that you won’t bear the financial burden of an accident caused by someone else, even if they are uninsured or underinsured.

By alleviating these costs, ICBC allows you to recover and get back on the road without significant financial strain.

Underinsured or Uninsured Drivers

When the at-fault driver lacks adequate insurance, ICBC protects you:

- Comprehensive Support: ICBC covers repair costs, vehicle replacement, or even medical expenses if needed.

- No Financial Strain: Even in cases where the other driver has little or no insurance, ICBC ensures you aren’t left facing overwhelming out-of-pocket expenses.

This added layer of protection provides security and reassurance during what can already be a challenging and stressful time.

ICBC Coverage: What’s Not Covered and Key Limitations

While ICBC’s Basic Vehicle Damage Coverage offers extensive protection, there are important limitations to keep in mind:

- Accelerated Depreciation: The policy does not account for any decrease in your vehicle’s value after repairs. This means the diminished resale value of your car following an accident is not covered.

- At-Fault Accidents: If you are responsible for an accident, repair costs for your vehicle will not be covered unless you’ve added ICBC’s Optional Insurance Coverages, such as Collision Coverage.

Understanding these exclusions helps you assess whether additional coverage might be necessary to fully protect your vehicle and finances.

Optional Coverages to Strengthen Your ICBC Policy

To bridge the gaps in Basic Coverage, ICBC offers a range of optional coverages that provide additional protection tailored to your needs:

ICBC Collision Coverage

Collision coverage helps if you’re involved in an accident where you are at fault. It covers the cost of repairing your vehicle, even if you’re responsible for the crash.

Comprehensive Coverage

Comprehensive Coverage safeguards your vehicle from non-collision-related damages, such as:

- Theft

- Vandalism

- Natural Disasters (e.g., hail, falling trees)

This coverage provides broad protection for events beyond your control.

Extended Third-Party Liability

This coverage expands the protection offered by Basic Coverage if you cause damage or injury to another person or their property. It:

- Increases coverage limits for greater financial security.

- Provides peace of mind in serious accidents where damages exceed the Basic Coverage limit.

Adding these optional coverages can strengthen your ICBC policy, ensuring you’re fully protected in a variety of scenarios.

How do you access ICBC coverage?

ICBC makes purchasing or renewing Basic Vehicle Damage Coverage simple and convenient, offering multiple options to suit your preferences:

Through Autoplan Brokers

Visit your nearest Autoplan office, where licensed brokers are ready to assist you. These professionals will:

- Guide you through the process of purchasing or renewing your Basic Coverage.

- Help tailor your policy to meet your specific needs.

Online Tools

ICBC’s website offers a range of tools to help you manage your coverage easily. Online, you can:

- Renew your policy.

- Update your personal or vehicle details.

- Make adjustments without the need for an in-person visit.

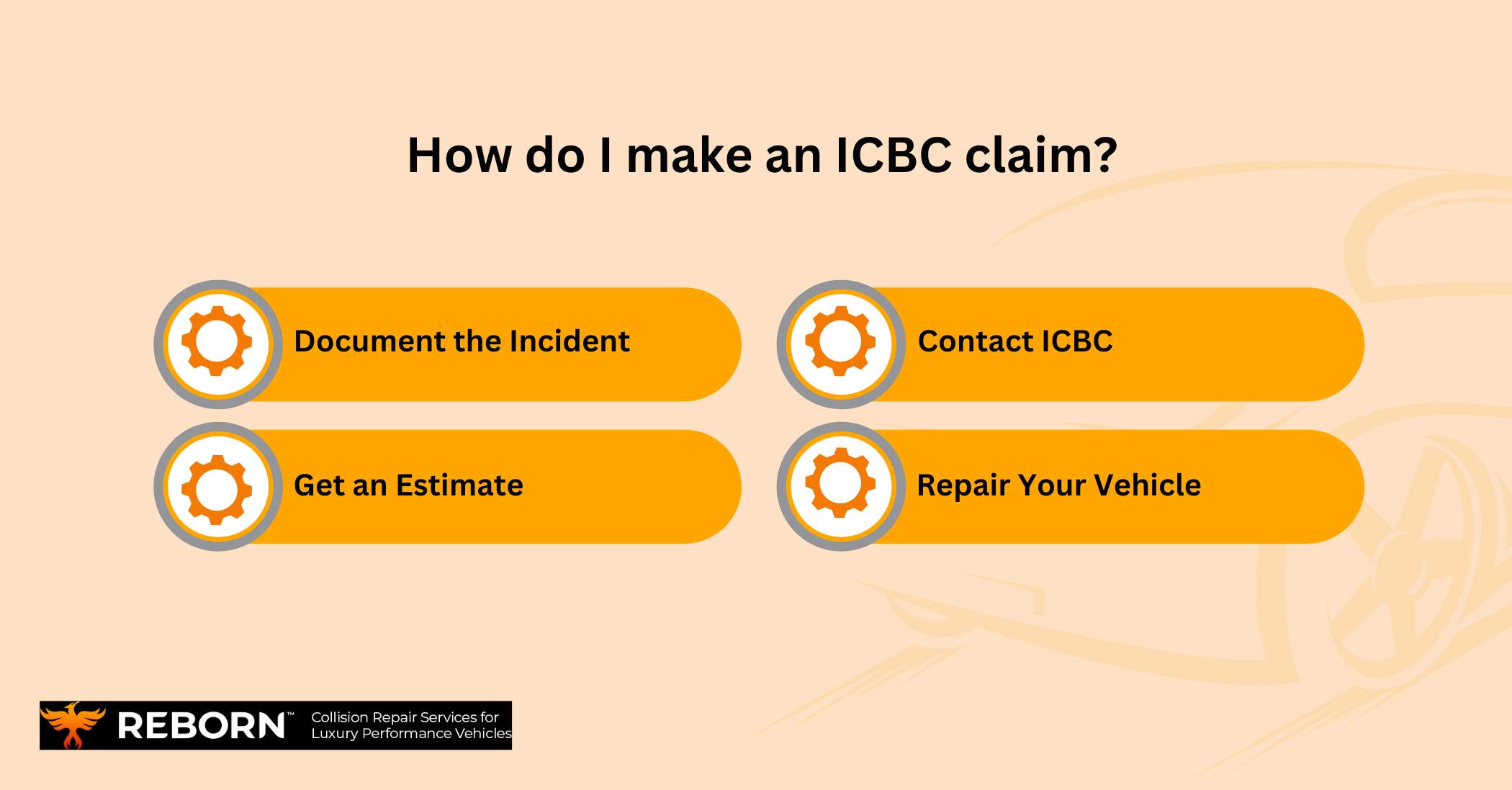

How to file an ICBC claim?

Filing a claim under ICBC’s Basic Vehicle Damage Coverage is a simple and straightforward process designed to help you quickly address vehicle damage. Follow these steps to ensure your claim is handled efficiently:

1. Document the Incident

Start by gathering all the necessary details about the accident:

- Take Photos: Capture clear images of the damage to your vehicle, other vehicles, or property involved.

- Gather Information: Record essential details such as the date, time, location, and circumstances of the accident. Exchange contact details, license plate numbers, and insurance information with other drivers involved.

- Witness Statements: Collect contact details of any witnesses, as their input may be useful during the claims process.

2. Contact ICBC

Once you’ve documented the incident, report the claim to ICBC. You can do this in one of two ways:

- Online: Visit ICBC’s website to report your claim through their user-friendly online portal, which will guide you step-by-step.

- By Phone: Call ICBC’s claims hotline to report the incident and receive instructions on the next steps.

3. Get an Estimate

After filing your claim, you’ll need a repair estimate for your vehicle.

- Use Reborn Autobody’s AI Damage Estimator for a quick and easy preliminary assessment of your vehicle’s damage. This tool provides an approximate cost and helps you understand the scope of repairs required.

- For a detailed inspection, visit an ICBC-approved repair shop.

4. Repair Your Vehicle

Once your claim is processed and an estimate is finalized, proceed with the repairs. Work with ICBC’s network of approved repair shops to ensure your vehicle is restored to the required standards.

In Closing

Understanding ICBC’s Basic Vehicle Damage Coverage empowers you to handle your insurance needs confidently. While the basic plan offers solid protection, exploring additional coverage options can provide even greater peace of mind.

If you’re unsure about your current coverage or need expert assistance with repairs, Reborn Autobody’s collision repair services are here to help. Our team is ready to guide you through your insurance claims and provide professional repair services. Visit us today to drive with confidence, knowing you’re fully covered and supported.